Faculty

- Huang-Yu Wang Huang-Yu Wang

- Jiunn-Rong Yeh Jiunn-Rong Yeh

- Tay-Sheng Wang Tay-Sheng Wang

- Ming-Chiang Lin Ming-Chiang Lin

- Chueh-An Yen Chueh-An Yen

- Tzu-Chiang Chen Tzu-Chiang Chen

- Ming-Jye Huang Ming-Jye Huang

- Tsung-Fu Chen Tsung-Fu Chen

- Wang-Ruu Tseng Wang-Ruu Tseng

- Huang-Chih Chiang Huang-Chih Chiang

- Shu-Huan Shyuu Shu-Huan Shyuu

- Chien-Liang Lee Chien-Liang Lee

- Yu-Hsiung Lin Yu-Hsiung Lin

- Jen-Guang Lin Jen-Guang Lin

- Kuan-Ling Shen Kuan-Ling Shen

- Wen-Chen Chang Wen-Chen Chang

- Chao-Ju Chen Chao-Ju Chen

- Hsin-Chun (Wallace) Wang Hsin-Chun (Wallace) Wang

- Ching-Ping Shao Ching-Ping Shao

- Ming-Hsin Lin Ming-Hsin Lin

- Shih-Tung Chuang Shih-Tung Chuang

- Chung-Jau Wu Chung-Jau Wu

- Nai-Yi Sun Nai-Yi Sun

- Ying-Hsin Tsai Ying-Hsin Tsai

- Yang-Yi Chou Yang-Yi Chou

- Ke-Chung Ko Ke-Chung Ko

- Wan-Ning Hsu Wan-Ning Hsu

- Sieh-Chuen Huang Sieh-Chuen Huang

- Chih-Jen Hsueh Chih-Jen Hsueh

- Heng-Da Hsu Heng-Da Hsu

- Yu-Wei Hsieh Yu-Wei Hsieh

- Su-Hua Lee Su-Hua Lee

- Neng-Chun Wang Neng-Chun Wang

- Wei-Yu Chen Wei-Yu Chen

- Yun-Ru Chen Yun-Ru Chen

- Hui-Chieh Su Hui-Chieh Su

- Yu-Hung Yen Yu-Hung Yen

- Yueh-Ping (Alex) Yang Yueh-Ping (Alex) Yang

- Kai-Ping Su Kai-Ping Su

- Christopher Chao-hung Chen Christopher Chao-hung Chen

- Chun-Yuan Lin Chun-Yuan Lin

- Hao-Yun Chen Hao-Yun Chen

- Yi-Wen Chang Yi-Wen Chang

- Yen-Jen Chen Yen-Jen Chen

- Patrick Chung-Chia Huang Patrick Chung-Chia Huang

- Mao-wei Lo Mao-wei Lo

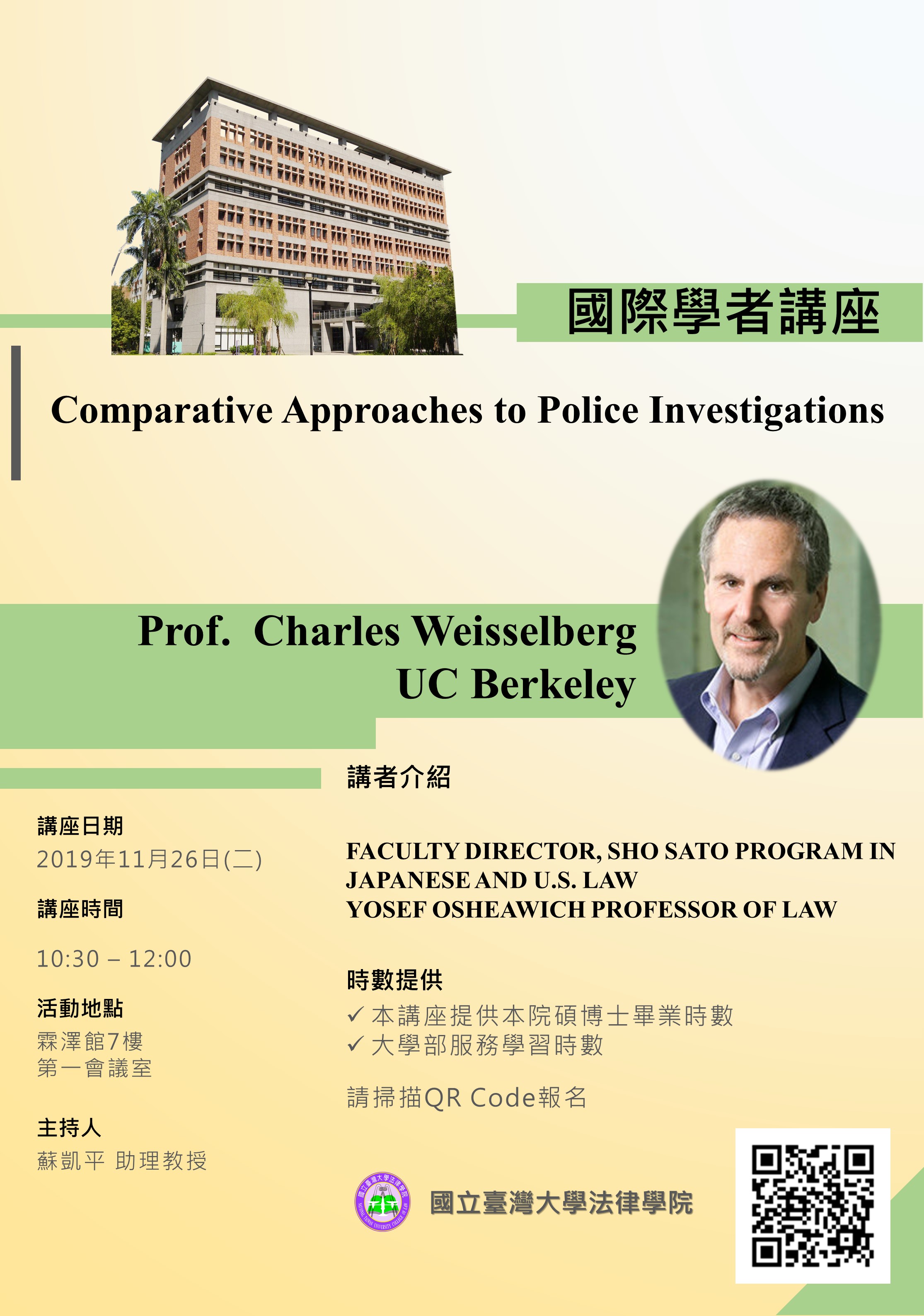

【專題演講】11/26 UC Berkeley Weisselberg 教授 "Comparative Approaches to Police Investigations"

【專題演講】11/26 UC Berkeley 馬雅里 教授 "The Family in Family Law in the 21st century"

How to apply

The details about the 2023 Summer Law Program:

https://oia.ntu.edu.tw/short-term-programs/courses/aCa8428D45B7

Application Online:

https://oia.ntu.edu.tw/short-term-programs/programs#Social%20Sciences

For more information, Please contact Ms. Wanping ZHONG.

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

10/1 (Tue.) Open Lecture - What Lawyers Should Know About the Current State of the Global Financial Markets

The open lecture co-conducted by Mr. Rick Grove and Mr. Jonanthan Ross introduced a series of financial marketing law topics including:

1. The impact of global political tension including the trade war on financial markets

2. Replacement of LIBOR - the key market benchmark

3. Global regulation of financial markets

4. The rise of specialist financial courts

5. Implications of current geo-political events for financial markets

6. The importance of rule of law for the financial markets

- Time: 12:30-14:00

- Location: NTU College of Law, Tsai Lecture Hall 7th Floor, Conference Room.1701

6/5 (Wed.) Prof. Anthony J. Casey's Speech on "A Structured-Renegotiation Theory of Corporate Bankruptcy."

Prof. Anthony Casey of the University of Chicago Law School shared his recent research findings "A Structured-Renegotiation Theory of Corporate Bankruptcy." With NTU Law school students and professors.

In professor Casey's study, he pointed out the shortcomings and limitations of the mainstream “Creditors’ Bargain Theory” in bankruptcy law. Compared with the assumption of creditor's hypothetical negotiations before bankruptcy from the perspective of practical operations, Professor Casey believes that the operation after bankruptcy is more critical, and thus constructs this "structural renegotiation theory" (Structured-Renegotiation Theory).

【6/5】美國芝加哥大學 Anthony J. Casey 教授演講

芝加哥大學法學院Anthony Casey教授分享其最近的研究成果「A Structured-Renegotiation Theory of Corporate Bankruptcy」。在此一研究中,Casey教授指出,破產法上主流之「債權人談判理論」(Creditors' Bargain Theory)的不足與限制。相對於想像債權人於破產發生前之假設性的談判,從實務上的運作觀察,Casey教授認為破產發生後的運作更為關鍵,據此建構了此一「結構性再談判理論」(Structured-Renegotiation Theory)。在演講結束後,主持人邵慶平教授、本院林仁光教授、中研院張永健研究員及法研所魏欣柔同學提出許多問題與Casey教授進一步交流。